When it comes to mobile gaming, staying ahead of the curve on ad revenue trends is essential to successfully navigate the landscape.

A recent report by data.ai sheds light on the significant impact and growth of mobile game ad revenues. With huge amounts of spending in the mobile sector — a major portion of which is dedicated to ad investments, and mobile games playing a dominant role — it’s clear that mobile game ad revenues are shaping the advertising landscape in profound ways.

Let’s delve into the key findings of the report, explore winning strategies, and take a snapshot of the mobile app economy to uncover the secrets to success in mobile game ad revenues.

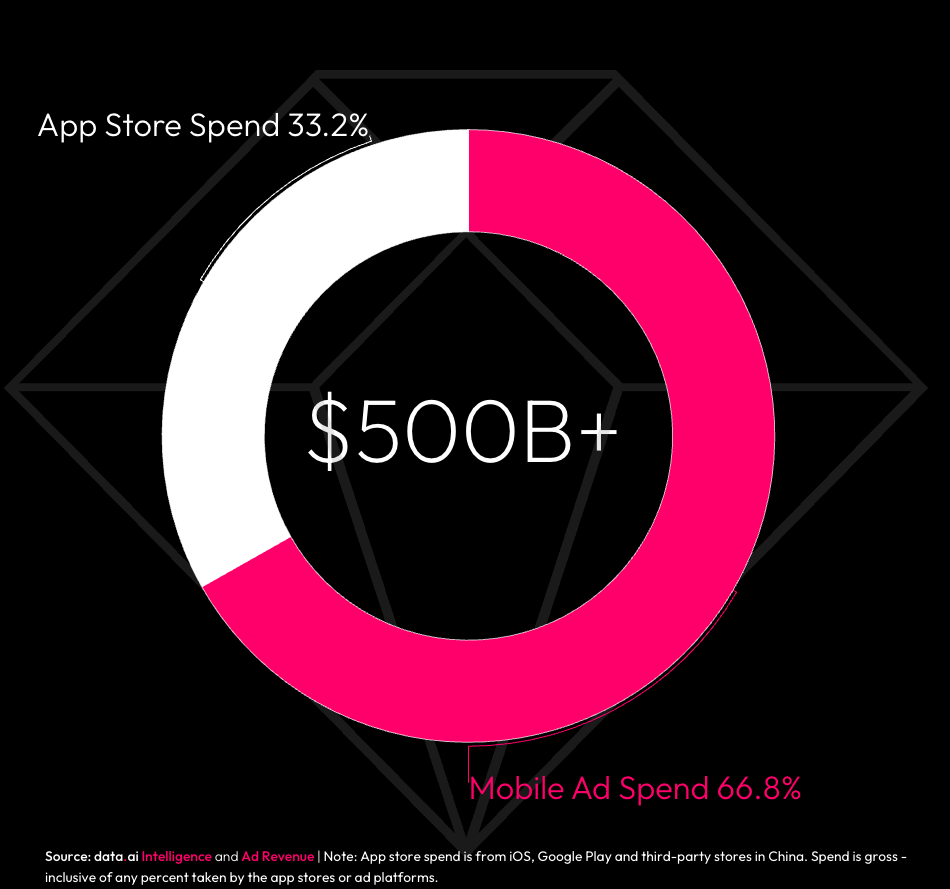

Mobile industry spending: A $500 billion landscape

The mobile app economy is worth a staggering $500 billion — 33% of which originates from in-app purchases (IAP) and subscriptions and a significant 66% from mobile ad spend.

Take a moment to grasp the enormity of this figure. A whopping $336 billion was invested in mobile ads alone in 2022.

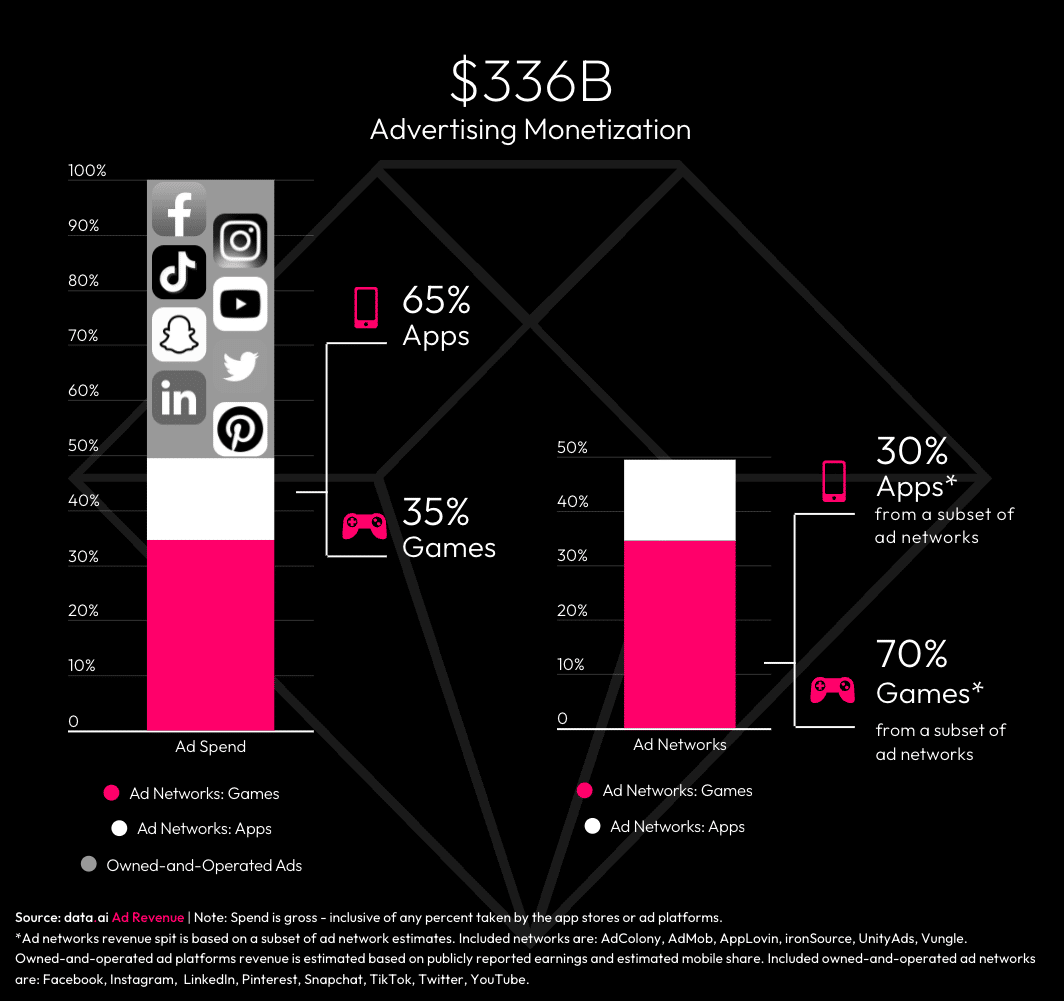

The distribution of mobile ad spend between apps and games is particularly enlightening. Excluding owned-and-operated ad platforms such as Meta, Snapchat, TikTok, and others, mobile games accounted for approximately 70% of ad spend — an astonishing $116 billion in 2022. The impact and significance of mobile games in the advertising landscape is remarkable.

Advertising insights: Winning strategies, successful categories, and going global

1. Game companies that win embrace hybrid monetization strategies

By combining advertising, IAP, and subscriptions, companies that lean into hybrid monetization strategies cater to different player preferences and unlock their full revenue potential. A diversified approach allows them to monetize non-paying users through advertising, while offering premium features for engaged players willing to make in-app purchases or subscriptions.

Hybrid monetization maximizes revenue and provides a safety net against market fluctuations and shifts in user behavior, ensuring greater revenue stability.

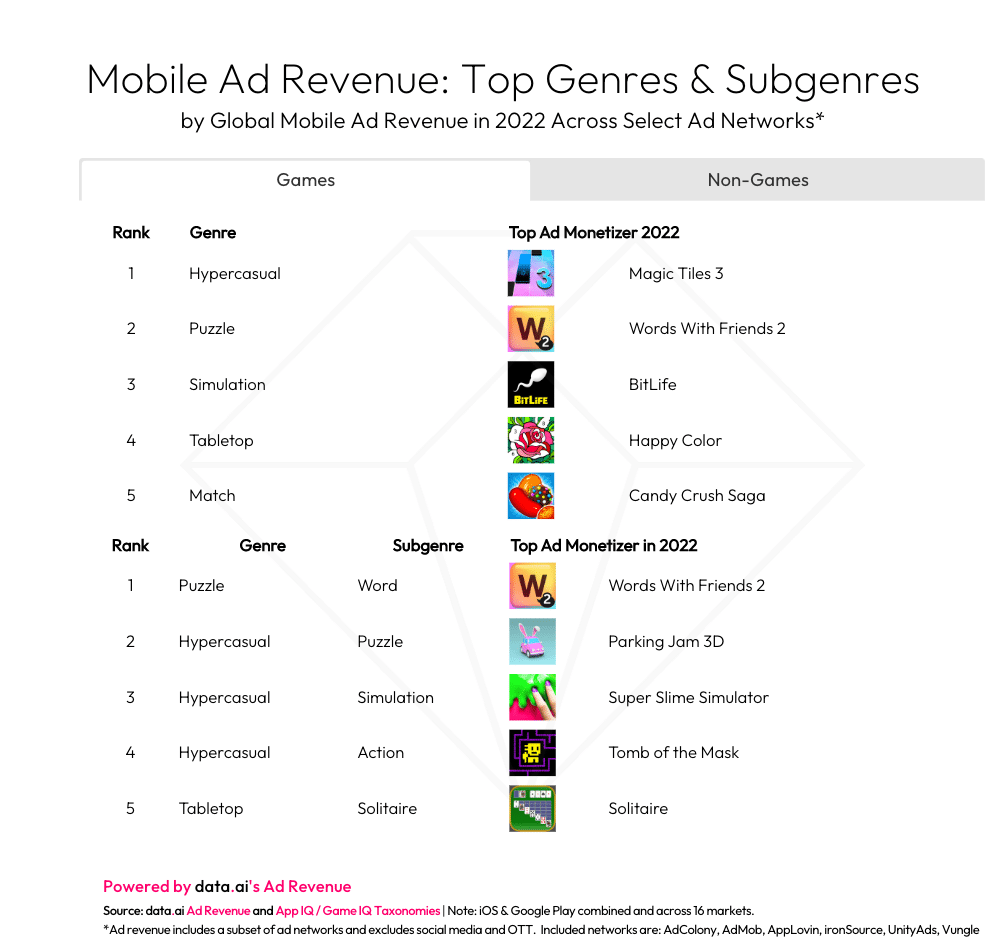

2. The most successful categories in ad monetization

Certain app categories consistently outperform others in terms of ad monetization. Social media apps such as Instagram and TikTok, with their massive and highly engaged user bases along with personalized advertising capabilities, command a significant share of ad revenues.

Mobile games, with their ability to deliver immersive, in-context advertising experiences, also enjoy high levels of user engagement. Video streaming and news apps often excel in ad monetization as well, as users have grown accustomed to consuming ad-supported content within these contexts.

3. Ad revenues are global

The digital nature of mobile apps has transformed advertising into a truly global marketplace.

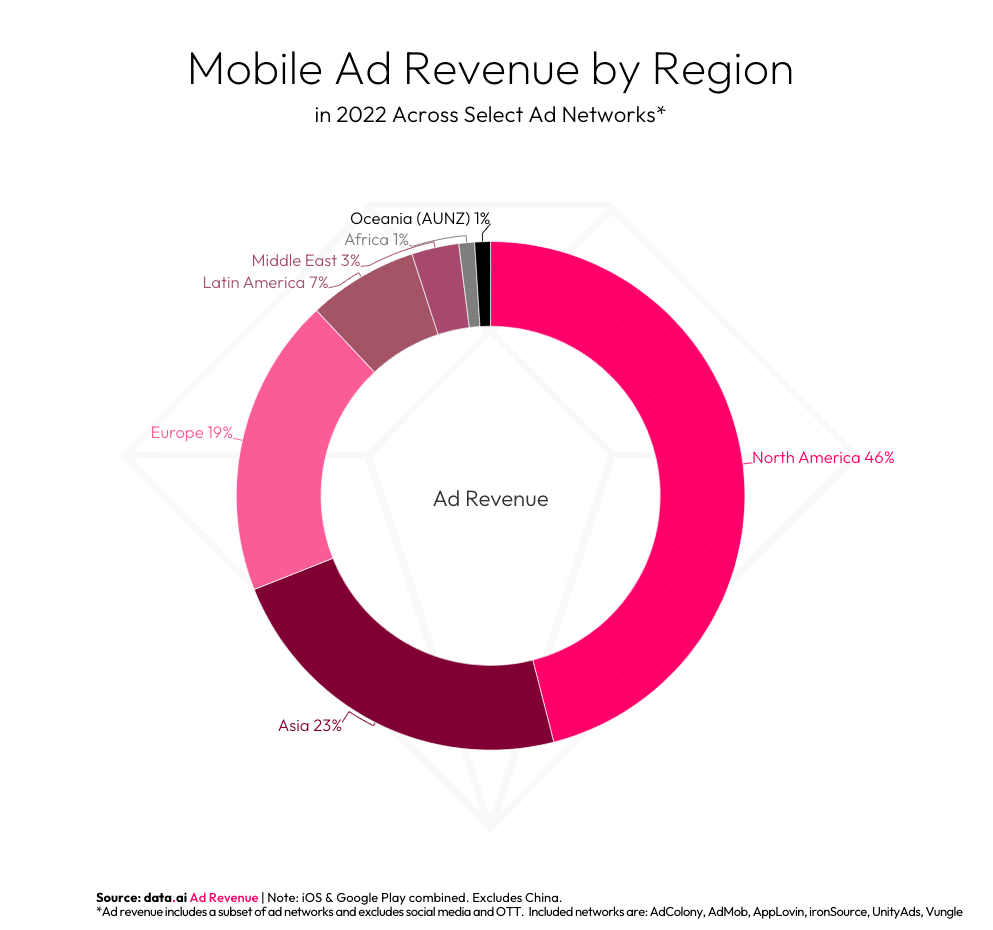

While traditionally large markets such as North America remain major contributors, emerging markets are playing an increasingly significant role. Asia, excluding China, now accounts for nearly a quarter of global mobile ad revenue. Europe also makes a substantial contribution. Global reach enables advertisers to tap into diverse user bases, expanding their potential impact and ROI.

Moreover, advancements in ad technologies, localization efforts, and cultural understanding empower advertisers to create more targeted and effective campaigns tailored to specific regions. As internet penetration improves in emerging markets, the trend of increasing global ad revenue is expected to continue.

The mobile app economy: An overview

The mobile app economy surpassed $500 billion in 2022 — approximately 67% was generated through ad revenue and 33% from app store purchases. According to data.ai, this enormous economy was predominantly driven by a hybrid monetization strategy combining advertising and IAPs.

Ad and app store revenues

Ad revenue accounts for the income that app publishers earn through ad displays in their apps. Conversely, app store revenues consist of earnings from paid apps, IAPs, and subscriptions. Notably, subscriptions are increasingly prevalent among non-gaming apps, especially those in the video streaming and dating genres. Furthermore, non-games accrued about 65% ($220B) of the $336B mobile ad spend in 2022.

Mobile ad spend and game monetization

While owned-and-operated ad platforms from top social media and video streaming apps constitute around half of overall ad expenditure, the removal of these giants indicates that 70% of mobile ad spend is directed toward games. Popular gaming genres including hypercasual and puzzle rely on networks such as AppLovin and Vungle for monetization.

Insightful metrics like average revenue per purchasing user (ARPPU) and lifetime value (LTV) are used to assess and benchmark app monetization over time. Furthermore, IAP behavior provides insights into user purchasing behavior outside of a specific app.

App store spending and revenue distribution

In 2022, app store spending reached $167B. iOS accounted for half of this amount, Google Play followed with 27%, while third-party stores in China (excluding Google Play) made up the remaining 23%.

Almost two-thirds of app store revenue came from mobile games. Ninety-eight percent of this revenue was derived from one-time in-app purchases. On the other hand, non-gaming apps saw 71% of their income from in-app subscriptions.

Mixed monetization strategies and ad-supported subscriptions

Top revenue earners across different sectors, including social networking, mobile gaming, and video streaming, have adopted mixed monetization strategies. More than half of the top apps are monetizing through both advertising and in-app purchases. Furthermore, over-the-top (OTT) platforms such as Netflix and Disney+ began incorporating ads to offer lower price points, and these ad-supported subscriptions are expected to gain popularity over time.

Certain apps including YouTube, Duolingo, and the game Magic Tiles 3 have effectively employed a strategy that offers a premium subscription for ad removal, leading to increased revenue. This underscores the importance of versatile and dynamic monetization strategies in driving revenue growth in the mobile app economy.

Regional insights and genre performance

So where does mobile revenue originate? Notably, North America led the charts in 2022, accounting for nearly half of global mobile ad revenue. The US took the top spot for ad revenue on both iOS and Android platforms.

Asia (excluding China) followed at 23%, with Europe trailing closely behind at 19%. The rest of the regions made up the remaining 12%.

In mobile game ad revenue, hypercasual games outperformed all other genres in 2022, followed by casual genres such as puzzle and simulation. The top five mobile game genres alone were responsible for over half of all ad revenue monetization across all mobile apps via the included ad networks.

When including owned-and-operated ad platforms such as Facebook and YouTube, non-gaming apps notably accounted for 65% of total advertising revenue monetization on mobile. Among social media apps, communication apps generated the highest ad revenue.

Diverse ad monetization and market trends

Interestingly, while casual games continue to dominate the US mobile advertising space, non-gaming apps achieved greater success in many top Asian markets. For instance, leading ad monetizers in Japan included prominent players such as Line, Yahoo Japan, and Kakao Piccoma. These trends emphasize the diverse and dynamic nature of mobile ad monetization across different global markets and app categories.

So there you have it. The data tells us that as the global reach of mobile ad revenues and the utilization of versatile monetization approaches, developers and advertisers can look forward to promising opportunities in the world of mobile games.